Powerful California Down Payment Assistance

- March 22, 2024

- Down Payment Assistance

- 6 mins read

Comprehensive Guide to California Down Payment Assistance Programs

California Down Payment Assistance –

Challenges renters and new homebuyers face when trying to afford a down payment. Fortunately, California offers various state programs for down payment assistance (DPA) to help individuals achieve their dream of homeownership. In this comprehensive guide, we’ll explore the different California Down Payment Assistance programs available, discuss the documentation needed to apply, and delve into the benefits of down payment assistance. Additionally, we’ll present a comparison of the pros and cons of utilizing California Down Payment Assistance programs through a table format, empowering you to help make an informed home buying decision.

California Down Payment Assistance Programs

California Down Payment Assistance offers several programs to help renters and new homebuyers. These programs are administered by state and local government agencies, as well as nonprofit organizations, and they aim to provide financial assistance to eligible individuals who meet specific criteria. Here are some of the key California Down Payment Assistance programs available in :

- California Housing Finance Agency (CalHFA)

- California Down Payment Assistance Programs:

- CalHFA offers various DPA programs tailored to different income levels and homebuyer profiles. These programs provide down payment assistance in the form of grants or deferred-payment loans, helping homebuyers bridge the gap between their savings and the required down payment. Examples of CalHFA DPA programs include the CalHFA MyHome Assistance Program and the CalHFA ZIP Extra Down Payment Assistance Program.

- California Department of Housing and Community Development (HCD) Down Payment Assistance:

- The California HCD administers down payment assistance programs targeted at low and moderate-income households. These programs may offer grants, loans, or forgivable second mortgages to eligible homebuyers. Examples include the CalHFA Affordable Housing Partnership Program and the CalHFA School Facility Fee Down Payment Assistance Program.

- Local Government and Nonprofit DPA Programs:

- In addition to state-run programs, many local governments and nonprofit organizations in California offer their own DPA programs. These programs may have specific eligibility criteria based on location, income, or other factors. Examples include county-level assistance programs, city-sponsored initiatives, and nonprofit DPA programs such as those offered by Habitat for Humanity affiliates.

California Down Payment Assistance

Documentation Needed for DPA Application:

When applying for down payment assistance programs in California, applicants typically need to provide various documents to verify their eligibility. While specific requirements may vary depending on the program, common documentation includes:

- Proof of Income: Recent pay stubs, W-2 forms, tax returns, and other income documentation to demonstrate household income.

- Employment Verification: Letters from employers or recent employment contracts to verify employment status and income stability.

- Bank Statements: Statements from checking, savings, and investment accounts to show available funds and financial reserves.

- Credit Reports: Credit reports and scores to assess creditworthiness and determine eligibility for certain DPA programs.

- Identification: Valid photo identification such as a driver’s license or passport to confirm identity.

- Homebuyer Education Certificate: Completion certificate from a HUD-approved homebuyer education course, which may be required by some DPA programs.

California Down Payment Assistance

Benefits of Down Payment Assistance:

California Down Payment Assistance programs offer several benefits to renters and new homebuyers:

- Increased Affordability: DPA programs help make homeownership more affordable by providing financial assistance for the down payment, reducing the upfront cash required to purchase a home.

- Expanded Homeownership Opportunities: By lowering the barrier to entry, DPA programs enable individuals with limited savings or resources to become homeowners, thereby expanding homeownership opportunities for low and moderate-income households.

- Improved Financial Stability: Owning a home can provide long-term financial stability and wealth-building opportunities. DPA programs help individuals transition from renting to homeownership, allowing them to build equity and assets over time.

- Access to Favorable Mortgage Terms: Some DPA programs offer additional benefits such as lower interest rates, reduced closing costs, or flexible loan terms, further enhancing affordability and improving overall mortgage affordability.

California Down Payment Assistance

Pros and Cons of Down Payment Assistance:

Below is a comparison of the pros and cons of utilizing down payment assistance programs:

Pros | Cons |

Increased affordability for homebuyers | Limited availability of funds |

Expanded homeownership opportunities | Eligibility criteria may be restrictive |

Improved financial stability | Potential resale restrictions |

Access to favorable mortgage terms | Additional paperwork and requirements |

Tailored assistance for low-income | Potential impact on debt-to-income ratio |

California Down Payment Assistance

Dream For All Program

The CalHFA Dream For All Program is one of the flagship down payment assistance programs offered by the California Housing Finance Agency (CalHFA). This program is designed to provide financial assistance to low and moderate-income individuals and families in California who aspire to become homeowners. Here’s how the CalHFA Dream For All Program works, its requirements, and eligibility criteria:

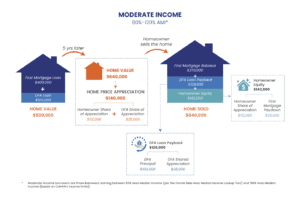

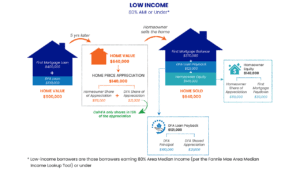

How Does the CalHFA Dream For All Program Work?

The CalHFA Dream For All Program offers down payment assistance in the form of a deferred-payment junior loan. This means that the assistance provided does not require monthly payments and accrues no interest. Instead, the loan is repaid when the home is sold, refinanced, or the primary mortgage is paid off.

Under this program, eligible homebuyers receive a junior loan of up to 3% of the purchase price or appraised value of the home, whichever is less, to be used towards the down payment or closing costs. The assistance can be combined with a CalHFA first mortgage loan or another eligible first mortgage program.

Requirements for the CalHFA Dream For All Program:

California Down Payment Assistance

To qualify for the CalHFA Dream For All Program, applicants must meet certain requirements, including:

- Income Limits: The program is available to households with income below specified limits, which vary depending on the location of the property and the number of people in the household. Income limits are typically based on the area median income (AMI) for the county where the property is located.

- Homebuyer Education: Completion of a homebuyer education course from a HUD-approved counseling agency is required for all borrowers. The course provides valuable information about the home buying process, financial management, and responsibilities of homeownership.

- Occupancy Requirements: Borrowers must intend to occupy the purchased home as their primary residence. The program is not available for investment properties or second homes.

- Eligible Properties: The CalHFA Dream For All Program can be used to purchase single-family homes, condominiums, and planned unit developments (PUDs) located in California.

- Other Mortgage Requirements: Borrowers must qualify for a first mortgage loan from a CalHFA-approved lender or another eligible first mortgage program. This may include meeting certain credit score requirements and debt-to-income ratio limits.

Credit Score Requirements:

While the CalHFA Dream For All Program does not specify a minimum credit score requirement, borrowers must meet the credit standards of the first mortgage lender. Typically, borrowers are required to have a credit score of at least 620 or higher to qualify for a conventional mortgage loan. However, borrowers with lower credit scores may still be eligible for certain government-backed loan programs, such as FHA or VA loans, which may be used in conjunction with the CalHFA Dream For All Program.

California Down Payment Assistance programs play a crucial role in helping renters and new homebuyers achieve their homeownership goals.

By understanding the different DPA programs available, gathering the necessary documentation, and weighing the pros and cons, individuals can make informed decisions about utilizing these valuable resources.

A licensed mortgage loan originator, will leverage their expertise to help guide you through the DPA process, ultimately helping you realize your dream of owning a home in California.

In summary, California Down Payment Assistance – the CalHFA Dream For All Program offers valuable down payment assistance to low and moderate-income homebuyers in California, allowing them to overcome financial barriers and achieve homeownership. By meeting the program’s requirements, completing a homebuyer education course, and securing a qualifying first mortgage, eligible individuals and families can access the assistance they need to purchase a home and fulfill their dream of homeownership in California.